Ready to Get Started?

Please give us a call or fill out our contact form and a member of our friendly team will be in touch.

We’re ready to help you today!

On a basic level, everyone knows their paychecks are taxed. Still, the abbreviations line-itemed on a paycheck might make it difficult to interpret the exact breakdown. So, we're simplifying payroll taxes by putting them in three major categories.

The main types of payroll taxes your business will encounter are:

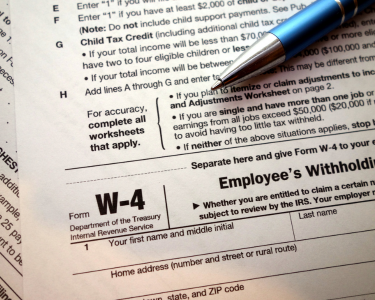

Income tax varies from person to person and depends on 1) how much the employee plans to withhold and 2) how much the employee earns. Since all labor should be accounted for, the income tax process starts before a new hire truly starts working.

This first step is to complete an IRS W-4 form. If an employee starts work before filling one out, your business might be subject to financial penalties. Many employers choose to automate their onboarding process to ensure the W-4 and other required documents are fully completed before a new hire's first day.

The W-4 is important, because the options selected by the new employee will determine the amount of money that will be withheld from each check for both federal and state taxes. Employees should fill out this form very carefully, since an error can lead to over-paying or large amounts being owed at end-of-year.

The IRS's tax withholding guide provides detailed instructions on translating the employee's selections into actual withholding.

The percentage of an employees income that's taxed depends on which tax bracket they fall into. While the IRS regularly adjusts these income thresholds, this amount was increased significantly in 2023—by about 7% to account for inflation.

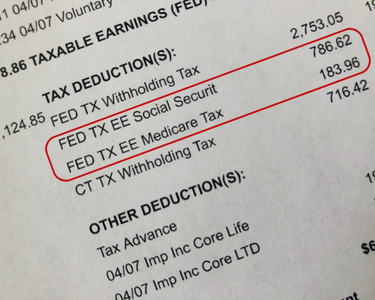

The Federal Insurance Contributions Act (FICA) was created in 1935 as part of the New Deal legislation, and its been around since. Its primary purpose is to maintain a system of social insurance to provide retirement benefits, survivor benefits, and disability benefits to eligible workers and their families.

The largest portion of a paycheck's FICA contribution is dedicated to Social Security, a program that provides income to the retired or disabled.

The largest portion of a paycheck's FICA contribution is dedicated to Social Security, a program that provides income to the retired or disabled.

Within that Social Security contribution, half is paid by the employer, and half is paid by the employee. In 2023, both employers and employees will be taxed 6.2% of gross pay on earnings up to $160,200. The employer and employee contribution combine for a total Social Security tax of 12.4%.

The second part of FICA is a contribution to Medicare, the federal medical insurance program. Just like Social Security, the Medicare tax consists of matched contributions by employee and employer. Each party pays 1.45% of gross salary.

Federal Unemployment Tax (FUTA) and State Unemployment Tax (SUTA) work in concert to make the final payroll tax deductions.

The base pay for calculating FUTA is $7,000 - that's the amount of annual income the federal government taxes (at a rate of 6%) for support of unemployment insurance programs. However, if the employee is in a state that is up-to-date in their contributions to this program, the FUTA tax rate is reduced from 6% to .6%. Historical data on FUTA credit reductions by state can be found on the Department of Labor's website.

The base pay and rates for State Unemployment Tax (SUTA) are highly variable by jurisdiction. Some counties and cities also levy an unemployment tax, but these instances are few and far between.

Federal, state, and city taxes can feel confusing. Yet, the penalties for late or non-payment can be very large. If you have a business of a certain size, you may also be required to pay on a more frequent schedule. The best way to avoid penalties for late and non-payment is by using Tax, Pay & File from Future Systems. You can automate your process, stay compliant, and never deal with the IRS again. Contact us today!

Please give us a call or fill out our contact form and a member of our friendly team will be in touch.

We’re ready to help you today!