Ready to Get Started?

Please give us a call or fill out our contact form and a member of our friendly team will be in touch.

We’re ready to help you today!

Stay up to date and learn new and exciting concepts on our Payroll Blog!

Get your head OUT of the clouds, and your payroll IN!

Read Article

When it comes to payroll, "Safety first!" is a mighty good motto.

Read Article

Make tax season painless by outsourcing your payroll and considering tax, pay & file options with Future Systems.

Read Article

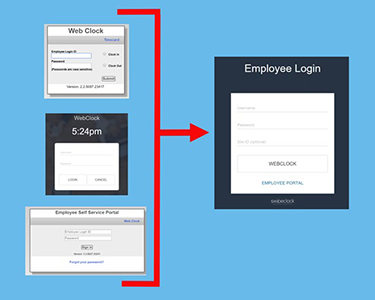

WebClock and the Employee Self Service login page will soon look a little different.

Read Article

At Future Systems, we believe that accessing helpful payroll reports should be easy and stress free.

Read Article

The best way to determine the status of a worker is by analyzing the employment situation and taking all factors into account.

Read Article

Starting and managing a small business is a lot of work. From money management to motivating employees and everything in between, you have a lot on your mind. The key to successfully managing your small business is delegation.

Read Article

With the tax deadline behind you, it's time to look forward. Learn more about the payroll tax changes for 2017 that every business should know.

Read Article

Whether you manage your company’s payroll internally or you outsource to a payroll processing service, understanding the ins and outs of payroll is extremely important.

Read Article

The new I-9 form needs to be used for new hires beginning January 22, 2017.

Read ArticleStay up to date and learn new and exciting concepts with our Payroll Blog!

Please give us a call or fill out our contact form and a member of our friendly team will be in touch.

We’re ready to help you today!