Ready to Get Started?

Please give us a call or fill out our contact form and a member of our friendly team will be in touch.

We’re ready to help you today!

Stay up to date and learn new and exciting concepts on our Payroll Blog!

Future Systems has helped numerous companies claim a combined total of more than $9M through the ERC, and your business might still be eligible, too.

Read Article

From a surge in remote working and WFH to vertical integration, 2022 promises to be full of exciting business trends. Here are three to watch in the year ahead.

Read Article

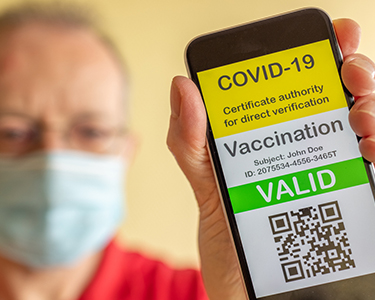

For the first time in history, the Biden administration's new COVID-19 vaccine mandate will apply to select private businesses. Read about the new regulation and how your business can prepare.

Read Article

You can now ask employees to sign documents digitally, generate notification emails and more with our new e-signature upgrades. Learn about the new possibilities for your business.

Read Article

Eligibility changes to the employee retention tax credit mean more companies can get much-needed support. Here's what you need to know for your business.

Read Article

The IRS has updated some notable tax dates and rates for 2021. Here's the deadlines you'll want to have on your calendar ahead of this year's tax season.

Read Article

Take a look as our President and CEO, Linda K. Hass, reflects on everything that happened in 2020.

Read Article

A letter from our President and CEO about how the derecho impacted the team at Future Systems, Inc.

Read Article

Wondering what steps your office should take in order to handle COVID-19, or coronavirus? Take a look at these best practices to implement into your workplace.

Read Article

FAQ on the new 2020 Form W-4

Read ArticleStay up to date and learn new and exciting concepts with our Payroll Blog!

Please give us a call or fill out our contact form and a member of our friendly team will be in touch.

We’re ready to help you today!